SURPLUS LINES 101

Click here to download our Surplus Lines 101 Handout

Click here to download our Surplus Lines 101 Handout

Our friends at the Wholesale & Specialty Insurance Association (WSIA) say it best when breaking down the unique purpose of surplus lines:

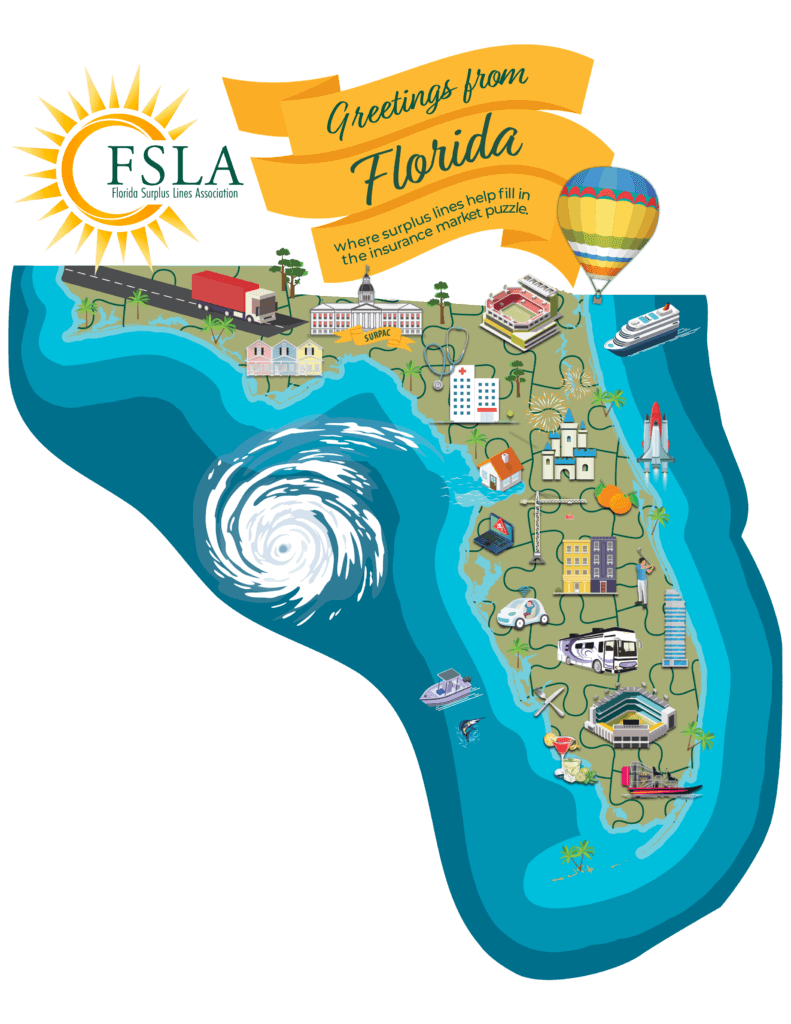

Often called the “safety valve” of the insurance industry, surplus lines insurers fill the need for coverage in the marketplace by insuring those risks that are declined by the standard underwriting and pricing processes of admitted insurance carriers. With the ability to accommodate a wide variety of risks, the wholesale, specialty and surplus lines market acts as an effective supplement to the admitted market. According to the Florida Surplus Lines Service Office, 2021 surplus lines premium volume was over $9.5 billion and represents over 1.2 million policies and consumers who, without the surplus lines market, would have a difficult time obtaining insurance, if they were able to secure it at all.

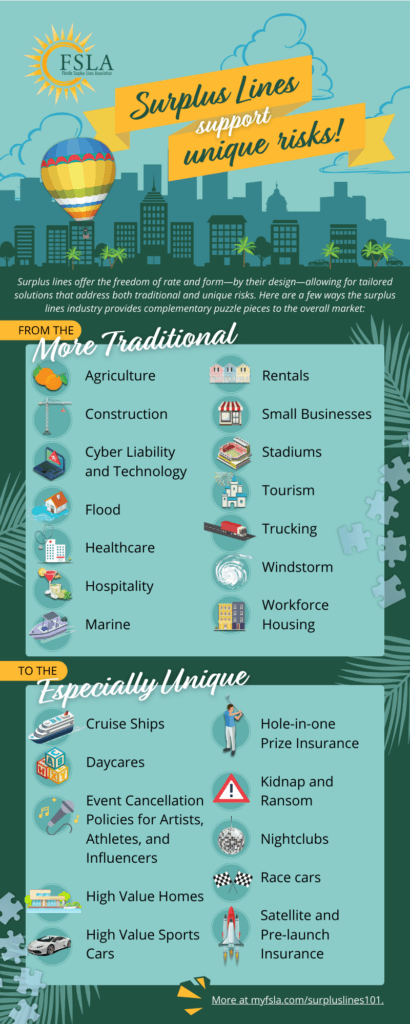

The surplus lines market plays an important role in providing insurance for hard-to-place, unique or high capacity (i.e., high limit) risks. Surplus lines insurers are able to cover unique and hard-to-place risks because, as non-admitted insurers, they can react to market changes and accommodate the unique needs of insureds who are unable to obtain coverage from admitted carriers. This results in cost-effective solutions for consumers that are not “one size fits all,” but are skillfully tailored to meet specific needs for non-standard risks.

Risks typically written in the surplus lines market fall into three basic categories:

(1) non-standard risks, which have unusual underwriting characteristics;

(2) unique risks for which admitted carriers do not offer a filed policy form or rate; and

(3) capacity risks where an insured seeks a higher level of coverage than most insurers are willing to provide

The wholesale, specialty and surplus lines business is immersed in current events and trends in the development of new products, new services, and in minimizing the risks of doing business in a world where the unforeseen is inevitable. The market is particularly important in efficiently introducing new products to the market. New and innovative products, and processes and procedures for which there is no loss history are difficult, if not impossible, to price or rate for insurance purposes. Surplus lines insurers are uniquely qualified to cover these emerging risks because they have developed this expertise through decades of experience.

Learn more about surplus lines or visit the WSIA website via their “What is Surplus Lines” page.